By Carlos Huerta

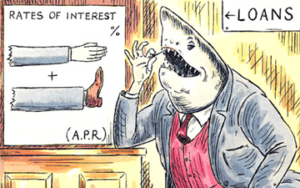

A car repair, a house repair, or a tooth repair for that one time you were texting while walking to the grocery store and that pole snuck up on you. These are few of the common things people often look to borrow money for in a crisis. Some people, if they qualify, will pay a low 2% Annual Percentage Rate (APR). Which equates to 2 dollars of interest every year on every hundred dollars loaned. Not bad for using someone else’s money to foot the bill.

Now, what would you say if a company looked to charge  you a 400% APR on your loan? The answer should be a startled “NO!” Yet, predatory lending practices, or payday loans as they are disguised, have sprouted, taking advantage of our city’s most vulnerable citizens. To put this in perspective, more payday lenders exist than Starbucks or McDonald’s within the City of Fresno.

you a 400% APR on your loan? The answer should be a startled “NO!” Yet, predatory lending practices, or payday loans as they are disguised, have sprouted, taking advantage of our city’s most vulnerable citizens. To put this in perspective, more payday lenders exist than Starbucks or McDonald’s within the City of Fresno.

Per the Pew Report, the average borrower takes out eight loans of $375 and spends $520 on interest by the time the initial loan is repaid. Individuals most likely to take a payday loan1:

- Are renters,

- Earn less than $40,000 a year (see figure 1),

- Have no four-year college degree,

- Are separated or divorced,

- Are African-American.

Fresno’s demographics put the majority of its population in these categories. In our region, where unemployment rates2 are more than double (11.4%) that of statewide (5.5%) or in the US (5.1%), residents of Fresno have long faced multiple barriers to self-sustainability. This includes, but is not limited to: language, credit, educational background, previous incarceration, extremely low home-owner rates and lack of access to resources and information. Residents are also cut off from opportunities due to inadequate training, coaching and lack of access to resources and information.

Because of these issues, in the city of Fresno alone there are 45 concentrated poverty census tracts3. Payday Lenders focus on these census tracts and set up shop in or near these census tracts. Though payday loans are a source of a short-term immediate emergency loan to cover unexpected expenses, it was found that 69% do not use a payday loan for these purposes and look to cover recurring expenses like rent, mortgage, food, etc.

alone there are 45 concentrated poverty census tracts3. Payday Lenders focus on these census tracts and set up shop in or near these census tracts. Though payday loans are a source of a short-term immediate emergency loan to cover unexpected expenses, it was found that 69% do not use a payday loan for these purposes and look to cover recurring expenses like rent, mortgage, food, etc.

When a payday loan is not paid off within the original 2-week payback period, the consequences start take hold of a person. It was found that from the day a person enacts a payday loan that person is in debt to pay back a simple $200-1,000 loan for about 200 days,  55% of a calendar year (figure 2). That person pays $10-30 of interest per $100 borrowed. At a weekly charge for 28 weeks a person can pay anywhere from as low as $560 of interest to $8,400. In most cases, the annual percentage rate (APR) on a payday loan averages about 400%, but the APR can as high as 5,000%4. APRs for credit cards can range from about 9% to 30%.

55% of a calendar year (figure 2). That person pays $10-30 of interest per $100 borrowed. At a weekly charge for 28 weeks a person can pay anywhere from as low as $560 of interest to $8,400. In most cases, the annual percentage rate (APR) on a payday loan averages about 400%, but the APR can as high as 5,000%4. APRs for credit cards can range from about 9% to 30%.

So what is the answer?

Here at the Center for Community Transformation we have been working to inoculate people against payday lenders. The idea is to build the knowledge sets and capacity of individuals to become more self-sufficient. Through a transformative 12-week financial literacy training, Faith and Finances, we are able to walk with people and develop their skills with everything from creating their first budget or spending plan, up to creating an emergency fund, becoming banked and establishing a more solid and healthy credit score. We know that at the end of the day we are not the experts in every community and our  reach is limited. This is why we value the collaboration and partnership with other partner organizations and individuals through Community Benefit Organizations (CBOs) and churches. How we accomplish reaching more and more families is by training a facilitator or facilitation team to go into their community and lead these transformational courses. Up to date, we have been able to train more than 50 facilitators and over 20 partner organizations here in the Central Valley to go into their communities and better prepare their neighbors against the financial pitfalls that exist. Our last training was just hosted June 16th and 17th (see picture below). Through this, we have seen hundreds of individuals complete Faith and Finances courses, with sustainable and actual results. Our goal is to reach all 45 concentrated poverty neighborhoods to ensure that those most vulnerable are not continuing to be enslaved to payday lenders and other predatory lending practices.

reach is limited. This is why we value the collaboration and partnership with other partner organizations and individuals through Community Benefit Organizations (CBOs) and churches. How we accomplish reaching more and more families is by training a facilitator or facilitation team to go into their community and lead these transformational courses. Up to date, we have been able to train more than 50 facilitators and over 20 partner organizations here in the Central Valley to go into their communities and better prepare their neighbors against the financial pitfalls that exist. Our last training was just hosted June 16th and 17th (see picture below). Through this, we have seen hundreds of individuals complete Faith and Finances courses, with sustainable and actual results. Our goal is to reach all 45 concentrated poverty neighborhoods to ensure that those most vulnerable are not continuing to be enslaved to payday lenders and other predatory lending practices.

So, in short, the answer that we have found to helping prevent people from being exploited is to build their capacity, their knowledge sets and help them be better prepared for when those unexpected expenses arise. This is all accomplished by participating in a local Faith and Finances course.

If you or someone you know is interested in Faith and Finances and becoming trained to facilitate workshops in your community, you can contact Carlos Huerta. Additionally, you can click here to learn more about Faith and Finances and here to see which CBO’s and churches are currently offering Faith and Finances in the city of Fresno or Clovis.

For a history on the beginning of Faith and Finances here in Fresno, you can click here.

You can also find alternative resources and options to payday loans.

Footnotes

1 Pew Report: Payday Lending in America: Who Borrows, Where They Borrow, and Why

2 US Bureau of Labor Statistics

3 Census.gov

4 https://www.credit.com/loans/loan-articles/the-truth-about-payday-loans/