Thinking about community transformation in the context of our 12 percent San Joaquin Valley unemployment rate means we must ask how churches and agencies can best empower individuals. How can we create sustainable change that affirms the dignity of our people? At times, a little rethinking, combined with deep relationships, can be all a church needs to ignite significant change. Of course, a little carne asada might help as well.

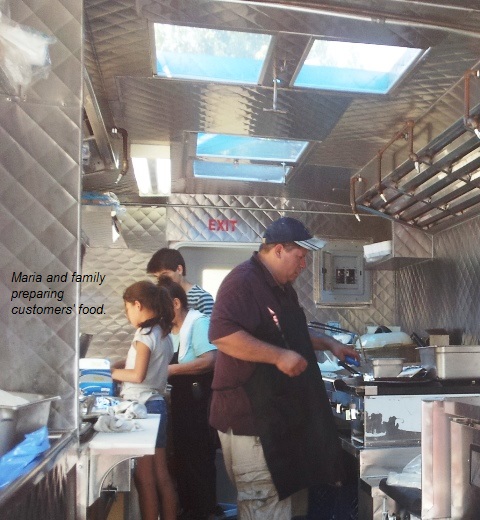

On June 30, in the hot Visalia sun, scads of customers anxiously awaited the highly anticipated tacos from Maria’s truck, a truck financed by a micro-loan from a local church. A blue shade could barely cool the many waiting in line. Maria, a grandmother and long-time Visalia resident and her family served each customer until there was no food left. Some had waited for an hour-and-a-half by the truck just outside the church to patronize the business, support Maria, and “taste their investment,” according to Stephanie Bartsch, missional strategist at Neighborhood Church.

It’s clear Maria is enthusiastic about the truck and about her relationship with the church. She said that she had no idea what would have happened to her if the church hadn’t collaborated with her. “I like my job and I like this truck…I am surprised and really happy,” Maria said.

Prior to this, she had rented space for her Mexican restaurant in a typical storefront. Unjust circumstances with her landlord led Maria to confide in Bartsch, a long-time friend and customer. Bartsch invited Brice Yocum, an attorney and director of business programs at the Fresno Pacific University Visalia Center, into the conversation. Yocum worked through legal issues with Maria and, along with Bartsch, “looked for ways to help her flourish and move on … and for ways they could empower her,” he said.

Yocum and Bartsch had an ongoing conversation with Maria for three months to determine the best course of action and decided that a food truck would give her “ownership of her time and place,” stated Yocum. Maria had saved up enough for operating costs, but the necessary deposit for the truck would have taken up her entire surplus.

They met with others at the church and asked what this would look like for the church to invest in Maria and her family. “I suggested to Stephanie that we start a microfinance fund. I was sure we could raise small investments from individuals and give Maria an opportunity to grow from a place of oppression that she was in into a place of empowerment,” said Yocum. He emphatically communicated to the congregation that this was not going to be charity, but freedom. They called the fund Empower Micro Loans.

In conversations with Maria, it was clear that if the church were to walk alongside her financially, this must be bigger than her. “Maria was much more excited about the idea of a loan than a hand-out,” stated Bartsch.

Bartsch and Yocum did not know what to expect when they presented their micro-finance plan to Neighborhood Church one Sunday in May, but knew that they had to take a step of faith and see God provide through his church. Their goal was to raise $3,000, the deposit for the truck Maria wanted to purchase. The response was completely overwhelming. In one Sunday, the congregation gave almost $10,000.

A committee soon developed as individuals from the congregation came to the fore, inspired by the vision and opportunity to use the spiritual gift of business. “God has gifted us with specific gifts to bring about restoration to the world… and we’re excited! They’re bringing restoration to the community through business,” exclaimed Bartsch.

A plan was created with Maria to pay off her loan within a year and a church partner was appointed to walk alongside her. The partnership with the church is there to encourage Maria personally and professionally,to be in an open dialogue with her throughout the process and to connect her with resources, business or otherwise.

A plan was created with Maria to pay off her loan within a year and a church partner was appointed to walk alongside her. The partnership with the church is there to encourage Maria personally and professionally,to be in an open dialogue with her throughout the process and to connect her with resources, business or otherwise.

Those involved with Empower remain attentive to where the Lord is leading them. They are awaiting their next partner who will walk with them in relationship to be blessed to be a blessing (Genesis 12). The goal is to include Maria and other individuals who have benefited from the Empower Fund to become members of the committee and to serve others in ways most befitting their cultural backgrounds.

The story of Maria and Empower might seem to be trouble free—everything falling into place easily. But,as one can expect, there were challenges. There were roles to clarify, logistics to handle and the details involved in the project that represented significant learning curves. Bartsch stated, “We’re trying to be really intentional to create a good project,” and shared their hope that future projects would be characterized by that high level of intentionality as well.

The significance of micro lending to Bartsch is that it provides an opportunity for friendship and allows for solutions that empower individuals. “We should be in the neighborhood and serving and loving people, but sometimes that love means ensuring the recipient is a partner, not just a receiver. It recognizes their dignity, increases ownership and builds a great sense of self,” she stated.

The folks at Empower are open to sharing what they’ve learned by this micro-finance project with other churches willing to experiment. Micro-lending and support of non-profit and for-profit organizations in the Valley is a critical direction for FPU and the Center for Community Transformation. “If we are to transform lives and empower leaders, we can do that with a model like this, working with the churches in the community,” Yocum said.

The folks at Empower are open to sharing what they’ve learned by this micro-finance project with other churches willing to experiment. Micro-lending and support of non-profit and for-profit organizations in the Valley is a critical direction for FPU and the Center for Community Transformation. “If we are to transform lives and empower leaders, we can do that with a model like this, working with the churches in the community,” Yocum said.

What advice would they give? “Jump in and try it. It may not be perfect at the beginning but it will develop over time,” Bartsch suggests. Just as God placed this opportunity in front of individuals at Neighborhood Church, God places opportunities in front of each of us, and it is our privilege to learn from stories like these and tailor them to make sense in our contexts. The CCT is launching a business plan contest for churches and agencies interested in doing small business development or employment strategies. Grants will be awarded to those chosen in early fall 2013. More information is available at 559-453-2367.

And for more information on how Maria’s dream was funded and the Empower Micro Loans process itself, visit here.